My education will cost WHAT?

White Investments’ Education Savings Solution (download our brochure)

For all you need to know about saving for your kids education – Questions and answers

A recent article (2014) highlighting the most expensive schools in South Africa, received loads of coverage in the social media arena in recent weeks. Apart from illustrating how prohibitively expensive a private education can be for most (R209,000 per year at the top of the list), the article clearly hit a nerve among parents from all walks of life.

Unless you are in that top 1% of South African’s who will find these amounts easy going, or your little treasure has some very loving grandparents who are able to shoulder the burden, perhaps you’d do well to consider what it is going to take to give your child the education you desire.

A good starting point is to identify what the cost of your chosen high school is likely to be in the future. If you have given birth this year (2014), your child is likely to start high school (Grade 8) in 2028. The good news is that this is quite a long way off – This will give you plenty of time to save and invest, earning compound returns to achieve your goal. Unfortunately, the distant time frame is also the bad news, as inflation is going to make school fees more expensive each and every year.

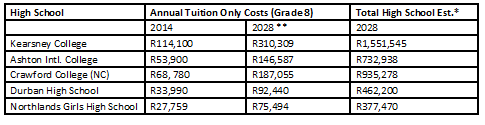

Using some actual ‘local’ school examples, we can approximate the cost of a high school education for a child born in 2014 – Figure A:

Source: Kearsney College, Northlands Girls High School, Crawford College North Coast , North Coast Courier Newspaper (August 2014) & White Investments.

If you want to start putting money away monthly to reach these respective totals by the beginning of your child’s high school education, the table below provides an estimate of what you need to save each month for the next 13 years (from birth). Additionally, if you are fortunate enough to have some spare cash lying around and can invest a lump-sum amount today, the estimated amount required is in the final column for each respective school.

Figure B:Monthly contribution requirements or a lump-sum

Source: White Investments ***

If you are like the majority of people who read these figures, you have probably been stunned into a temporary state of mild paralysis around about now, the severity of which is dependent on the number of children you have or are planning to have. After all, it is scary enough covering all the additional costs when baby arrives, let alone thinking about high school.

The post-paralysis-phase typically involves making a choice between two options:

(i) Bury your head in the sand in the hope that things will somehow work out in the end (We are blessed with ample opportunity for this on the North Coast’s scenic beaches).

(ii) Action a savings & investment plan that will allow you to do the best you can to lighten the burden and increase your child’s options for a decent education when the time comes.

As with all investment plans, the sooner you start saving, the easier reaching your goal becomes, thanks to the wonders of compounding returns. While the figures above assume you start saving from birth, don’t get despondent if you feel you are already behind as it only gets more difficult the later you leave it.

Figure C: Monthly savings contributions required at birth and then at 5 years old

If you find yourself deciding on option (ii), White Investments is well equipped to help you set up a simple and cost effective investment solution that will give you the best chance of providing the education that you want for your children.

I would like to thank Kearsney College, Northlands Girls High School and Crawford College North Coast for their feedback and in helping us to provide some more realistic target values.

*For simplicity sake we have assumed school fees stay the same for each of the five years to get to a total estimated cost for high school – Of course in reality the early years are less expensive than the latter ones. **An annual increase in school fees of 8% has been assumed.

***These figures assume a return of 12.5% per year (the annual average South African equity market return since 1900 – Credit Suisse Handbook 2012) with contributions made from birth. We ignore tax implications for the purpose of simplicity.

ballito, ballito investment advice, education costs, education savings, best investment advice, best schools

If you have any questions or want further advice on how to structure your investments or improve your personal finances please contact us at info@whiteinvestments.co.za

0 comments