|

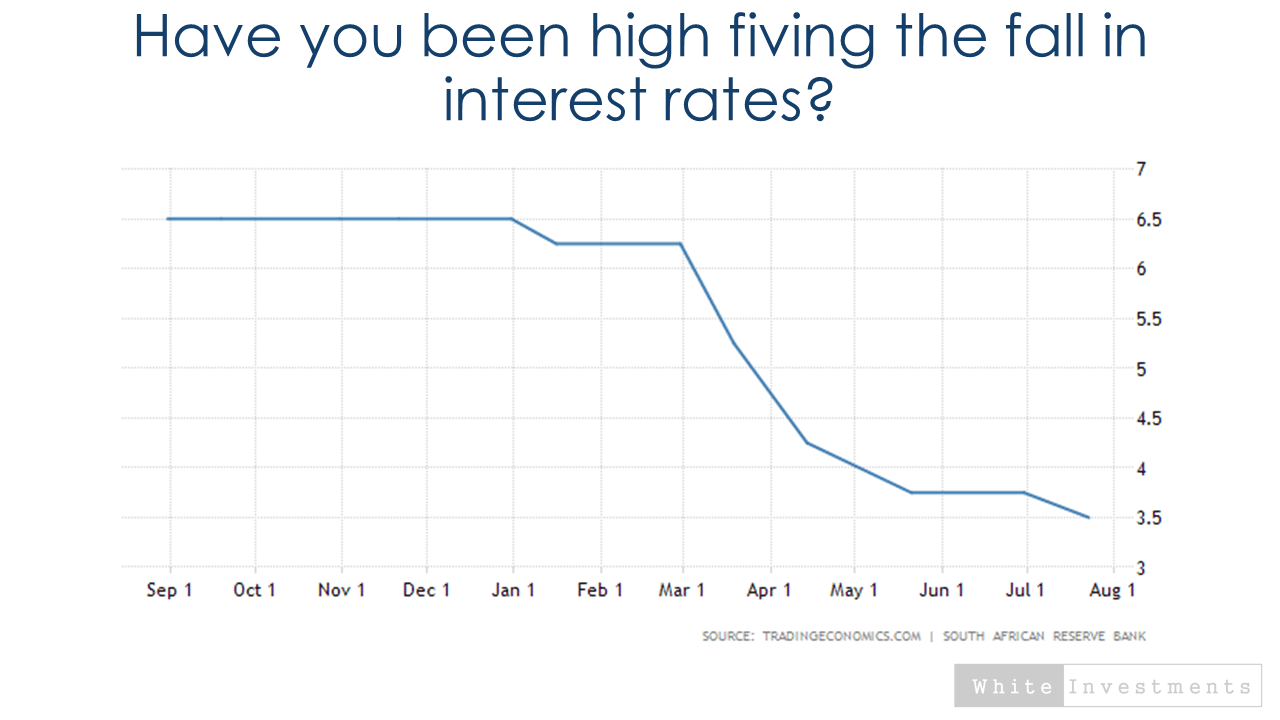

Just in case you don’t come from a finance or investment background, the concept of a risk free rate of return is the foundation of return expectations for just about anything you could invest in. Let me explain. As a reminder “returns” are what you get for letting someone else use your money. So if I know I can let the bank use my money and they will give me R7 for each R100 that I let them use each year (7% return), I am unlikely to let someone else use my R100 unless they pay me more. Afterall I am almost certain that my money in the bank will still be there when I need it…. it could be referred to as risk free or alternatively the risk free rate of return. How much more I expect anyone else to return to me depends on how long they want to use it and the probability that I will get my money back when I need it or indeed at all. If I invest in shares I basically agree to let the companies I invest in use my money indefinitely. I accept that in return I own a portion of their profits but I have no certainty that those companies will generate profits or indeed even survive. To invest in shares I therefore require a much higher return than the “risk free rate” I receive when letting my bank use the money. Using a little art and a little science let’s agree that I would let companies use my money if they paid me the risk free rate (same as my bank) plus another 5%. So l invest in shares rather than leave cash in the bank if I could reasonably expect I would get 12% (7+5) for letting them use my money rather. Here is the problem….. the risk free rate is linked to interest rates. The bank may have paid me close to 7% at the start of 2020 but they are only going to pay me 3.5% now, because the South African Reserve Bank (SARB) have cut interest rates significantly in response to the pandemic. My return for letting a company use my money must reasonably now be 8.5% (3.5+5) instead of 12% (7+5). I am still being compensated by the same amount over and above the risk free rate. For my expected returns from shares to fall to 8.5%, one of two things must have happened: Basically what has happened is as the returns from cash have fallen, investors have become more comfortable paying more for their shares and accepting lower future returns as a result. Bottom line is that future returns are likely to be lower going forward for just about everything you can invest in. With interest rates near zero and bond yields negative in many cases in the developed markets, the concept of return free risk is now a reality and creating all sorts of problems around how to decide what to invest in and when. What does a low yield environment actually mean for you? |

When you build an investment solution to target a specific objective or goal you have an implicit return expectation that you need to achieve in order to reach your goal.

Lets say we needed to have R1000 in 20 years time. We have R100 to invest today and could put another R10 away each year. When you run the numbers you will find out that your investment will need to grow (a return of) at 9% per year to reach your goal.

The next step in your strategy would be to choose investments (the broad asset classes being cash, bonds, shares, property) which are expected to deliver that return over time. Simple enough.

The problem we face is that this pandemic, and specifically the responses thereto, are lowering the return expectation on basically everything you could invest in. Crucially the future returns may be significantly lower than we have been projecting when putting together solutions.

If we were expecting 9% in the past (example used above) and now the return is closer to 4.5%, it means in order to still have R1000 available in 20 years time:

– You need to put away R24 per year instead of R10.

– You need to have saved up R285 to invest upfront rather than the R100 you now have.

Your other options are to:

– Accept that you will reach your target of R1000 in 30 years instead of 20 years.

– Accept that 20 years from now you will have R555 instead of R1000.

None of these options are particularly palatable in terms of our planning process.

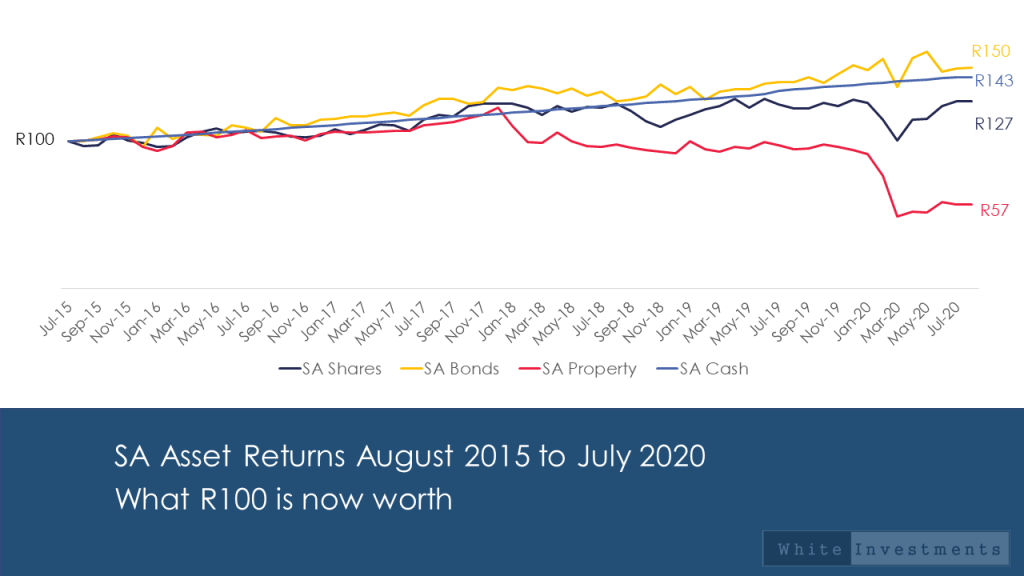

Perhaps the obvious solution is simply to take on more risk to keep our returns closer to the 9% level than the 4.5%. The unwelcome truth is that taking on more risk does from not always lead to higher returns as can be seen in the graphic below which shows how R100 has grown when invested in broad South African asset classes over the last five years.

The truth is that managing this process probably requires making adjustments in your personal finances, your expectations and your investment strategy.

Even if you are one of the lucky minority who have not had your income impacted by this pandemic, you may still have to divert more of your disposable income to your investment goals in order to achieve them in the time horizon and to the same extent to which you had initially planned.

So next time you look at your bond statement and are high fiving the lower repayment charges, remember with one hand interest rates giveth and with the other they taketh away…. maybe you even need to divert the savings on your bond to boosting your investment contributions if you can…