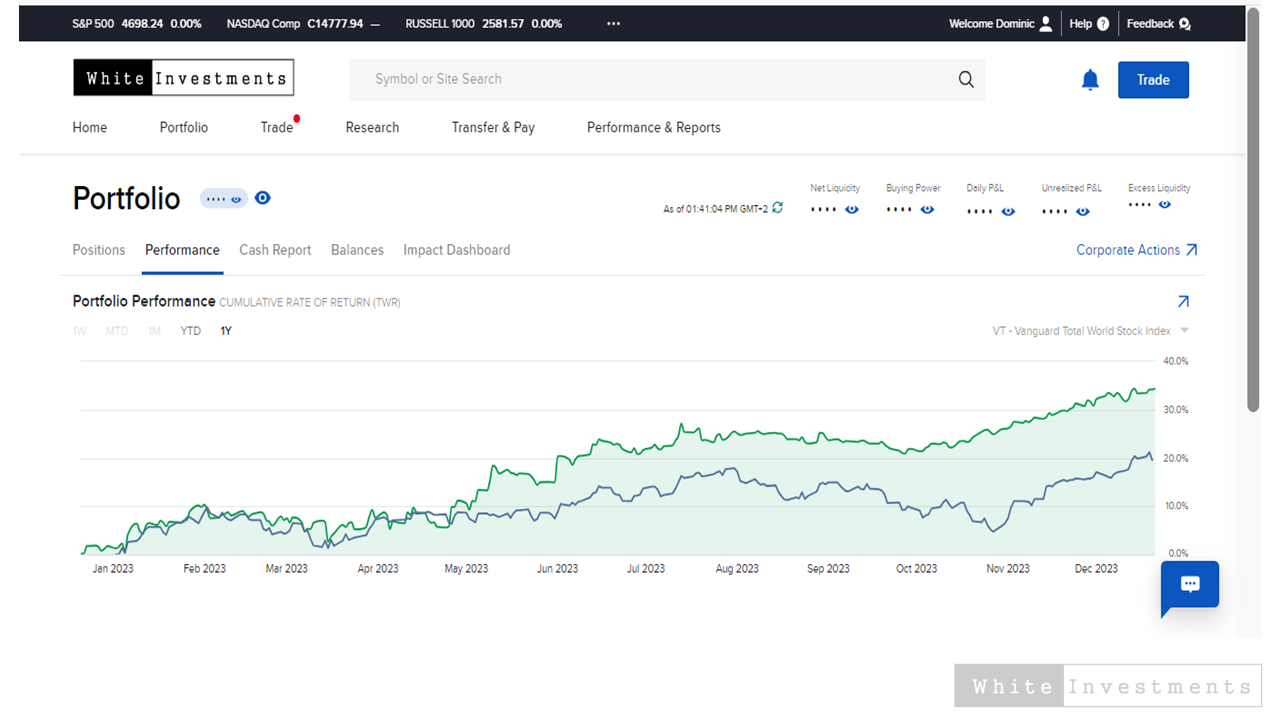

This is a screenshot showing an actual return from a portfolio I manage on my offshore platform of choice.

The GREEN line shows the portfolio performance and the BLUE line returns from a Global Stock Index.

Looks pretty good right?

Should be used in some kind of marketing strategy right?

But do you know what it does not tell you?

- How much risk was taken to achieve this return. And by risk I don’t mean volatility or how values fluctuated through the year. I mean the opportunity for a permanent loss of capital.

- What was the performance of this portfolio for the 5 years before 2023? If it was -80%, then these returns are still some way off of delivering any value.

- What was the objective of the portfolio? If this was a safe ‘I potentially need to spend the money in the next 12 months’ type portfolio, was this investment strategy appropriate?

- How much of this persons overall wealth does this portfolio represent? If this is their fool-around-money then it changes the perspective entirely. It is easy to take big risks and earn big returns when there is nothing really at stake.

When you are reviewing your returns, it is important to make sure you put them in perspective.

This is not about chasing the highest returns.

You are playing your own game.

You invest with your PURPOSE in mind and measure your results on that.

Want to find out about sending money directly offshore? Let’s chat.